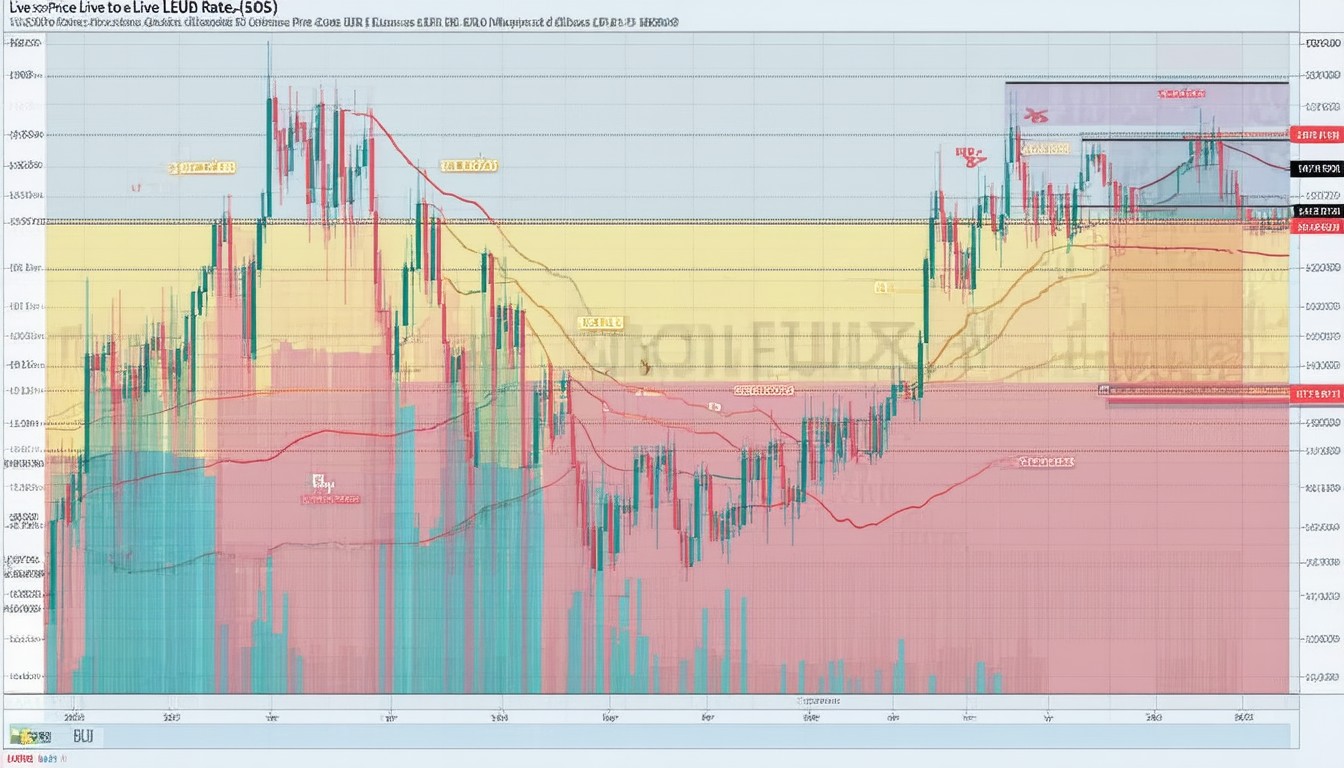

Track the latest Solana price in euros with live SOL to EUR rates, historical charts, and expert analysis. Discover key factors influencing Solana’s euro value and future outlook.

Understanding Solana: Key Drivers Behind SOL to EUR Rates

Solana (SOL) has emerged as one of the most talked-about digital assets in the global crypto landscape. Its combination of speed, scalability, and low transaction costs has positioned it as a solid competitor to long-established blockchains like Ethereum. For investors and traders across Europe, tracking the Solana price in euros (SOL to EUR) is essential for making timely decisions in a market known for its volatility.

The SOL to EUR rate is more than just a conversion factor between two currencies. It’s a reflection of broad economic influences, including global crypto market trends, the adoption of blockchain technology, and macroeconomic indicators across the eurozone. As Solana’s ecosystem expands—from decentralized finance (DeFi) protocols to digital art NFTs—its attractiveness as an investment vehicle continues to evolve.

Live Solana Price in Euro: What Moves the Market?

The real-time SOL to EUR price fluctuates based on supply and demand dynamics, but several core factors regularly exert influence:

- Market Sentiment: Crypto assets are highly responsive to sentiment shifts. Positive developments in Solana’s network—such as protocol upgrades or major partnerships—often trigger price surges, while security breaches or regulatory alarms may result in swift downturns.

- Eurozone Economic Trends: Shifts in the value of the euro itself, prompted by European Central Bank decisions or inflation reports, can impact the purchasing power of investors in the region, subtly shaping SOL to EUR rates.

- Global Crypto Regulation: Announcements from European financial authorities, such as ESMA or the ECB, can introduce uncertainty or clarity. For example, ongoing discussions around MiCA (Markets in Crypto-Assets) regulation continue to influence trading volumes and cross-border flows in and out of euro-denominated accounts.

- Solana Technology Milestones: Network performance metrics, such as transactions per second (TPS) improvements and downtime incidents, are closely tracked. In 2023, Solana’s consistently high throughput and reduced transaction costs have cemented its reputation among developers and institutional players.

“A thriving developer ecosystem and rapid performance improvements have pushed Solana to the forefront of blockchain innovation. For euro-based investors, these fundamentals often translate directly into price responsiveness against the euro,” says digital asset strategist Lea Hoffman.

Historical Analysis: Solana’s Performance Against the Euro

Looking back at Solana’s journey, its price movements in relation to the euro have mirrored both global crypto cycles and specific European market developments. During the 2021 bull run, SOL experienced exponential growth, with valuations increasing many times over in both USD and EUR terms. However, the subsequent tightening of monetary policy in Europe and a broader “crypto winter” illustrated how tightly Solana’s gains were linked to risk appetite and capital flows in the eurozone.

Key Events Shaping Solana’s EUR Performance

- 2021-2022 Bull and Bear Cycles: SOL soared alongside other leading tokens amid massive inflows into DeFi and NFTs, before retracing as inflation concerns and interest rate hikes dampened speculative fervor.

- Crypto Regulation in Europe: The introduction and debate around MiCA cast a long shadow, with moments of regulatory clarity spurring buying activity, while periods of uncertainty drove volatility.

- Liquidity Shifts: Several major euro-based exchanges expanded listings of SOL, increasing accessibility and impacting capital inflows from European investors.

Real-World Use Cases: Linking Price and Adoption Trends

Beyond price charts and daily rates, the euro value of Solana is closely tied to real adoption stories across Europe and beyond.

Decentralized Finance (DeFi) Growth

Solana’s high throughput and low fees have attracted European DeFi projects seeking to scale. Kusama and other decentralized applications (dApps) running on Solana have seen robust growth in euro-denominated assets under management (AUM).

NFT Markets and Creator Economies

NFT marketplaces powered by Solana have seen a surge in listings and sales, particularly among emerging artists in Berlin, Paris, and Barcelona. Euro-pegged stablecoins on Solana have made onboarding users in the eurozone notably smoother—minimizing FX friction for both creators and collectors.

Institutional Interest

Several European fintech firms are piloting tokenized assets and payment solutions via the Solana network. The participation of regulated entities lends greater legitimacy and can support the SOL to EUR price in times of broader market uncertainty.

Tracking SOL/EUR: Tools, Charts, and Best Practices

Monitoring the live SOL to EUR rate is critical for both traders and long-term investors. Reliable crypto exchanges and financial platforms offer up-to-the-second quotations, historical charts, and a raft of analytics tools for technical and fundamental analysis.

Essential Platforms for Live Price Data

- CoinMarketCap and CoinGecko: Widely used for price monitoring and volume tracking, including EUR-based charts.

- Binance, Kraken, and Bitstamp: Top European exchanges supporting direct SOL/EUR trading.

- Portfolio Apps like Delta or CoinStats: These apps provide easy-to-visualize charts, portfolio integration, and price alerts for SOL against the euro.

Analyzing Trends and Patterns

Looking at 50-day and 200-day moving averages, trading volumes, and RSI (Relative Strength Index) can offer clues about the prevailing trend or potential reversal points. For euro-area investors, overlaying macro events—such as ECB policy announcements—on price graphs can bring nuance to trade and investment choices.

Solana and the Euro in the Broader Crypto Ecosystem

Solana’s price in euros is increasingly relevant as the euro emerges as a major fiat onramp into digital assets. While the majority of global crypto volume is still tied to the US dollar, euro-denominated liquidity has grown rapidly due to:

- The expansion of regulated euro-based stablecoins

- Strong user communities in Germany, France, the Netherlands, and Spain

- Improved fiat onramps through local payment methods (SEPA, Sofort)

This evolving infrastructure helps insulate SOL/EUR prices from isolated shocks in USD trading pairs, even if some correlation remains.

Key Takeaways and Strategic Outlook

Solana’s euro price encapsulates both global crypto forces and uniquely European influences. Its ongoing technological advancements, rising DeFi and NFT adoption, and deeper integration with regulated European markets point to a future where SOL/EUR may see greater stability and institutional participation. However, volatility is never far, making informed, real-time monitoring indispensable for participants at every level.

FAQs

1. Where can I check the live Solana price in euros?

Most major crypto exchanges and financial websites, such as CoinMarketCap and Binance, provide real-time SOL to EUR rates and interactive price charts.

2. What drives changes in the SOL/EUR exchange rate?

Key factors include overall market sentiment, eurozone economic data, regulatory developments in Europe, and updates within the Solana network itself.

3. How does Solana compare to other cryptocurrencies for euro-based investors?

Solana’s high performance and growing ecosystem make it an attractive option compared to other tokens, especially for users seeking speed and low transaction fees with direct EUR trading pairs.

4. Can I buy Solana with euros directly?

Yes, many European exchanges and fintech platforms support direct purchases of SOL with EUR through SEPA transfers, bank cards, or euro-denominated stablecoins.

5. Are SOL/EUR prices affected by European regulations?

European regulatory changes, such as those related to Markets in Crypto-Assets (MiCA), can influence SOL/EUR prices by impacting market access, investor confidence, or legal clarity.

6. What tools can help analyze Solana price trends with respect to the euro?

Technical analysis tools (like moving averages and RSI), live price alert apps, and historical performance charts are all valuable for tracking SOL/EUR and making data-driven decisions.